A year ago, a headline “The Recession of 2023 might surprise everyone” would have been prescient simply because it didn’t happen. On the contrary, last year showed surprising resilience and a pace of growth no one expected, despite forecasts of a slowdown or recession by most economists. 2023 was supposed to have been the year in which the economy succumbed to the sharpest increase in interest rates in four decades; tightening lending standards by the banks; and the end of pandemic-era government spending.

Accumulated savings from Covid-related shutdowns and receipts of stimulus checks were expected to have run out well before the end of the year helping foment a recession. This did not happen in 2023, but chances seem higher for 2024.

The Federal Reserve’s Finale

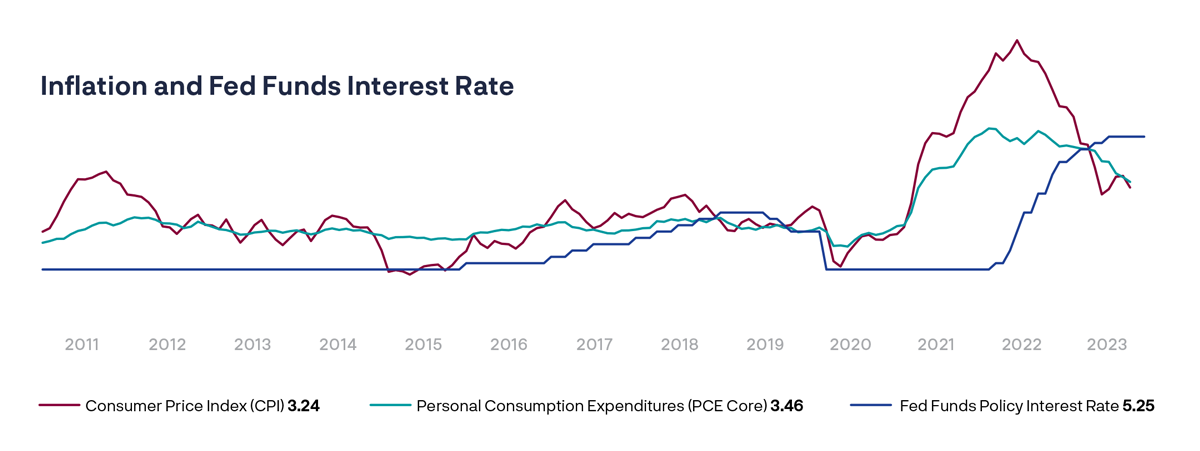

At December’s Federal Reserve Open Market Committee (FOMC) meeting the members indicated that the cycle of rate hikes has ended. Most of us opined that the policy interest rate (Fed Funds) will be cut several times through the course of the year. It appears (see Inflation and Funds Interest Rate graph) that inflation is on a path to the Fed’s 2% target, fulfilling the first part of its “stable prices and full employment” mandate. The challenges to achieving that goal are the tight labor market, persistent and surprising housing inflation, and economic activity being bolstered by an unanticipated boom in investment.

Looking for Slack in the Labor Market

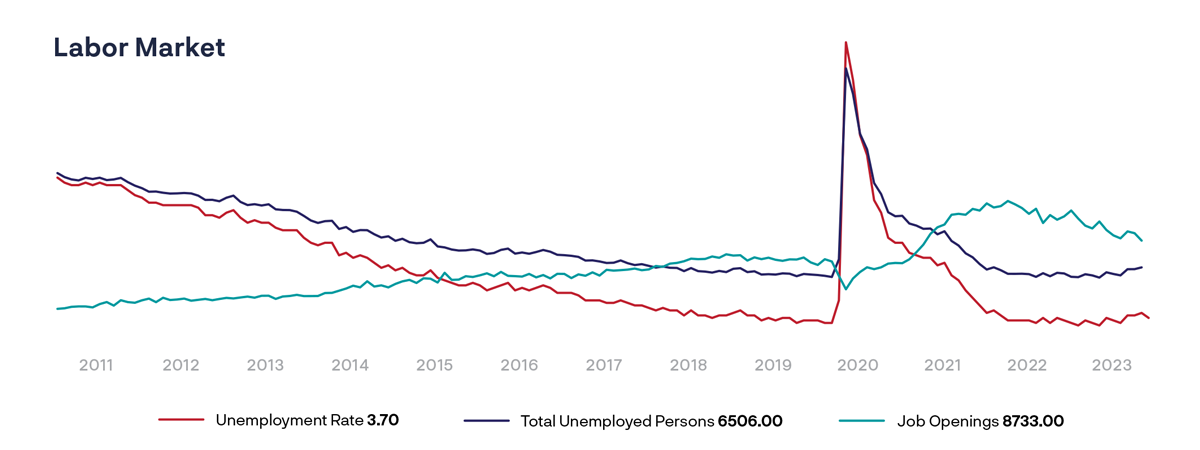

The unemployment rate hit a 50-year low at the end of 2022. At the same time, the number of job openings skyrocketed to double that of the unemployed. This data and mounting labor action sparked worries of a wage-price spiral akin to those of the 1970s (see Labor Market graph).

Job openings have declined but remain historically high compared to the number of jobless and the unemployment rate remains near all-time lows and at levels once deemed unlikely. Having succeeded in the second part of its dual mandate – full employment – the Fed wants more slack to feel comfortable.

Housing Dilemma

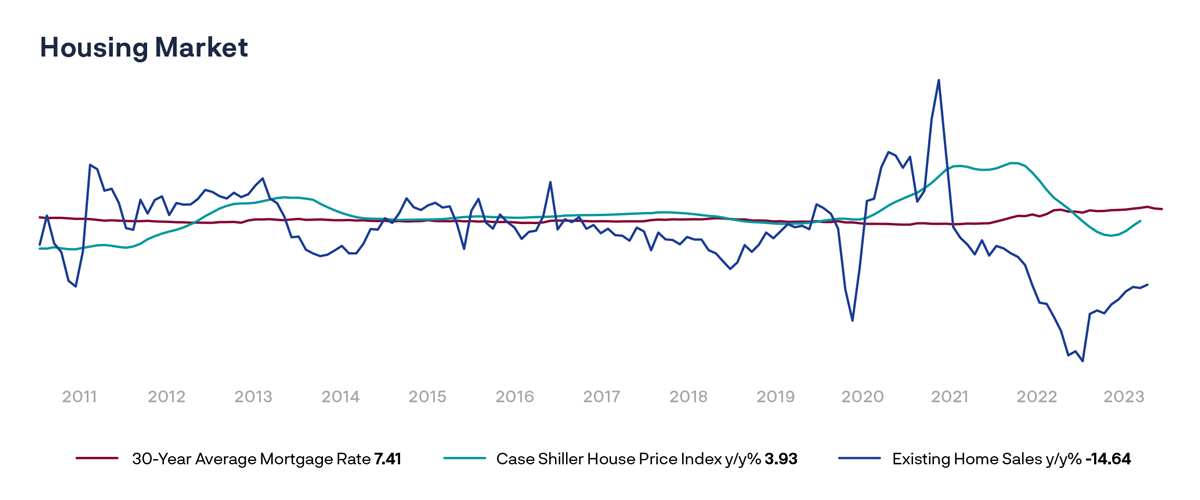

Inflation measures have been skewed higher due to the tight housing market. Representing more than a third of the inflation indices, housing or shelter prices play a dominant role. Measured by surveys rather than transactions, the slowdown in home sale volume and the decline in actual sales pricing is not captured in the graph. Instead, the persistent housing shortage, estimated to be near 4 million units, has led to an overestimation of value by people surveyed.

The Federal Reserve had hoped that a rise in mortgage rates would set off a decline in home prices due to a lack of affordability. Paradoxically, the rise in has led to a decline in home availability. Those who enjoy low mortgage rates are less likely to sell. Recently, Fed officials have noted this issue publicly and a “Supercore” inflation index that excludes housing in addition to food and energy has become popular as it may show a better metric.

Spending and Investment

Economic policies such as the Infrastructure Investment and Jobs Act, CHIPs and Science Act, and the Inflation Reduction Act have heightened spending and investment by the government directly and incentivized private industry to do so as well. These have contributed to an economy already buoyed by robust consumer spending and helped forestall the expected slowdown over the past year.

The Outlook for 2024

Expectations from the start of 2023 are repeating themselves for 2024. The bond market is pricing a series of interest rate cuts starting in the Spring on the belief that inflation will continue to fall towards the Fed’s target of 2% and implying that those cuts will be necessary as the economy flirts with recession.

Manufacturing

There have been studies suggesting that the Covid-era savings have been depleted among lower income households and soon will be for everyone else. Credit card balances have risen significantly. This coincides with a significant rise in payment delinquencies for credit cards, auto loans, and mortgages. The recent resumption in student loan payments adds another source of stress for millions of consumers. Higher mortgage rates have slowed home sales, and this will dampen activity in many related sectors from construction to household appliances. The commercial property sector has not recovered from Covid-era work transitions and is under pressure from higher interest rates, lower valuations, and more limited prospects. Private credit markets, undermined by higher interest rates, may be hiding vulnerabilities so far undetected. These developments imply a more fragile economy in the coming year and a growing likelihood of recession.

Standing in opposition to a recessionary outcome is an economy starting from a reasonably strong position. Unemployment remains near a multi-decade low and a small rise, while unfortunate for those put out of work, would be more in line with historic norms. A softening of this tight labor market would be a relief for policymakers, and many firms still need to fill vacant positions. In aggregate, consumer balance sheets are in good shape with debt to disposable income being in line with historic norms.

Rising credit card debt is far from being worrisome so consumers have significant borrowing capacity. Most of the banking sector is in good shape and the systemic problems that led to the Global Financial Crisis of 15 years ago are not apparent. House prices might come down in some markets, but with a housing shortage still generally present, a serious downward spiral is improbable. Finally, the Federal Reserve has significant room to cut interest rates to counteract a sharper than expected economic decline. Timed right, a soft landing could still take place even if the bad news outweighs the good.

On balance, a mild recession in the second half of the year seems likely. But the title of this article could also prove prescient when one fails to occur.

Get Your Financial Feed Today

The Financial Feed is the premiere publication for banking insights. Each issue prioritizes strategies on how business leaders can continue to grow despite possible economic headwinds. We hope these findings help you conquer potential challenges and capitalize on opportunities.

This information discusses general economic and market activity and is presented for informational purposes only and should not be construed as investment advice. The statements and opinions expressed in this article herein are those of the author as of the date of the article and are subject to change. Content and/or statistical data may be obtained from public sources and/or third-party arrangements and is believed to be reliable as of the date of the article.